How to find the right Chit company

By Sakthi Roopini K January 9, 2024

Chit funds are financial tools that facilitate group savings and borrowing, commonly employed in many countries. These funds operate through Chit companies, where a group of individuals contribute fixed amounts periodically.

Each contributor gets a chance to receive the total pooled amount, known as the chit value, through an auction process. Chit funds offer various benefits, such as aiding in regular savings, providing a lump sum amount when needed, and fostering financial discipline. However, it is crucial to choose the right Chit Fund company to ensure financial security. Opting for a reputable company helps mitigate risks associated with fraud or mismanagement, ensuring a reliable and secure environment for individuals participating in the chit fund. Therefore, selecting the right Chit Fund company is essential for individuals seeking the advantages of chit funds while safeguarding their financial interests.

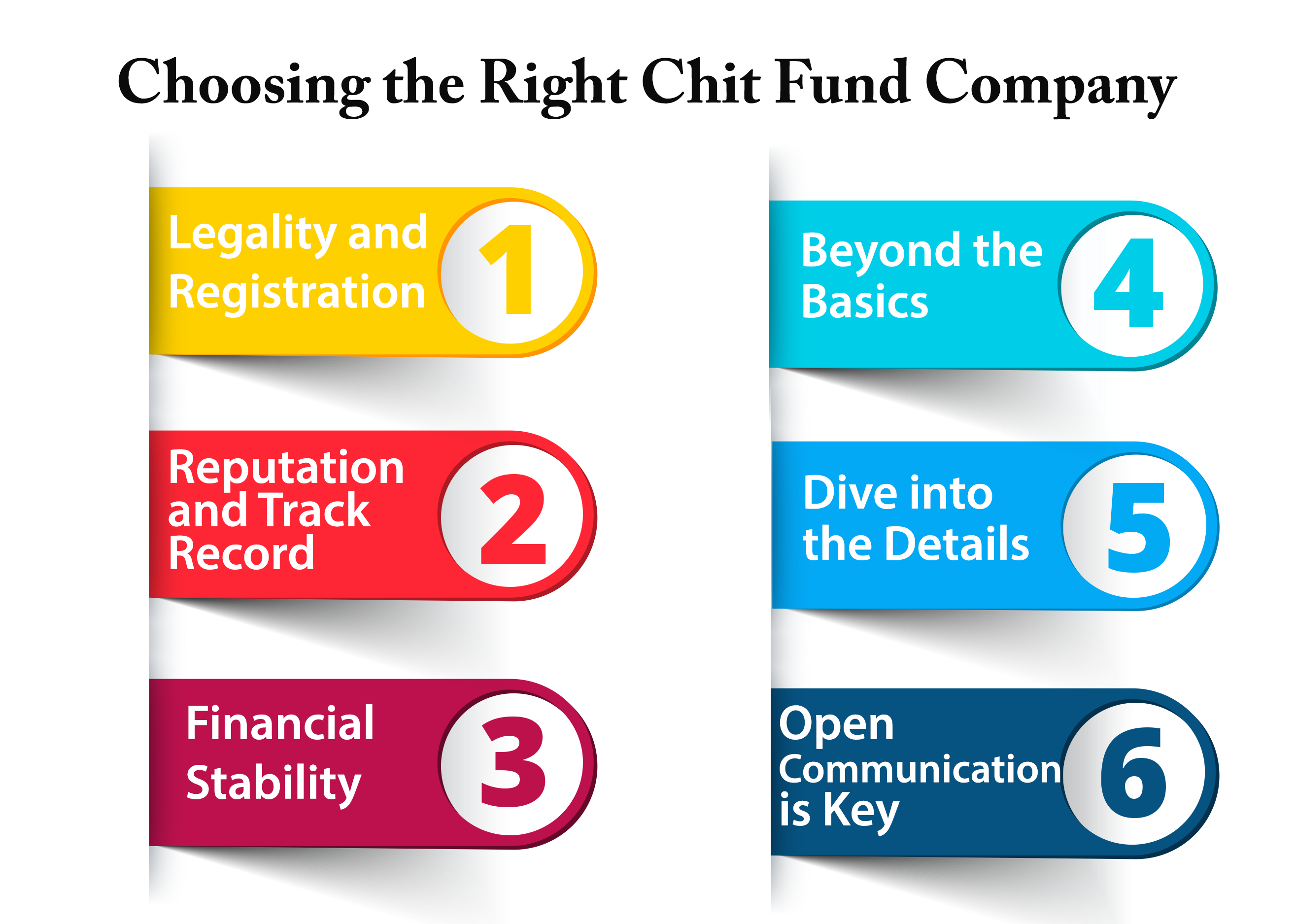

Choosing the Right Chit Fund Company: Essential Factors to consider

Navigating the world of chit funds can be exciting, but choosing the right company is crucial for a safe and rewarding experience. This essential guide will equip you with the knowledge to find a reputable Right Chit Fund company that aligns with your financial goals.

Legality and Registration: Your First Line of Defense

When it comes to choosing a Chit company, safety should always be your top priority. Never, ever join a chit fund that isn't legally registered! Look for companies registered under the Registrar of Companies (ROC) or the Registrar of Chits, depending on your region. Verifying this crucial detail is simple. Most companies display their registration number prominently on their website or office documents. You can also check it directly with the relevant registrar's office for added peace of mind.To avoid these hassles, you can also look upon compaies list from Chit Market where we list only the companies that are registered and are Chit Act Law compliant. This makes you take the trusted decision.

Looking to find the right company to invest Register with Chit market today!

Reputation and Track Record: Building Trust

Once you've confirmed legality, delve deeper into the company's history and reputation. Explore their website and social media presence to understand their values, mission, and past achievements. Older companies with a larger subscriber base often inspire more confidence. Consider researching online reviews and testimonials from existing members. This valuable feedback can reveal valuable insights into the company's service and reliability.

Financial Stability: Ensuring a Strong Foundation

A financially stable Right Chit Fund company is fundamental for a secure investment. Request their audited financial statements and pay close attention to their income, expenses, and debt levels. Look for positive credit ratings from recognized agencies, indicating trustworthiness and financial responsibility. Understanding the company's investment strategies can also be helpful. Do they invest in low-risk ventures or take on more aggressive approaches? Choosing a strategy that aligns with your risk tolerance is crucial.

Beyond the Basics: A Personalized Choice

While the factors mentioned above are crucial for every investor, consider your individual needs and preferences when making your final decision. What type of chit fund interests you? Do you seek a lump sum payout or regular installments? Understanding your financial goals and comparing them to the chit offerings of different companies is essential. Additionally, investigate the company's customer service policies and communication channels. Do they offer responsive support and clear communication? Feeling comfortable with their processes and interactions fosters trust and a positive experience.

Dive into the Details:

So you've chosen a Right Chit Fund company with a sparkling reputation and solid financial footing. Now comes the next big step - selecting the perfect chit fund scheme! Think of it like picking the right gear for a climb - you need something that fits your pace and takes you safely to the peak.

Each scheme is like a unique puzzle piece. Compare things like how long it runs (maturity period), how often you pay (subscription amount), and what happens if you can't keep up (foreclosure conditions). Most importantly, understand the "auction process." This decides who gets the lump sum payout early, and how much they pay for it. Choose a scheme that lets you reach your financial goals at the right pace, considering your risk tolerance. For bigger needs, a longer scheme might be better, while shorter ones offer quicker rewards.

Open Communication is Key:

Remember, a good Chit company is like a trusted friend – they keep you informed and readily answer your questions. Look for companies with clear and accessible communication channels. Are their contact details easily available? Do they offer multiple ways to reach them – phone, email, or even social media? Additionally, ensure they have a smooth grievance redressal process. If you ever have a problem, knowing how to get it addressed quickly and fairly is crucial.

Other things to consider

While comparing schemes and prioritizing communication are essential, don't forget to listen to your inner voice. If you're unsure, seek financial advice from trusted advisors or experts. They can help you analyze your financial goals and risk tolerance, and recommend schemes that align perfectly with your needs.

Remember, beware of unrealistic promises and unsolicited offers. If something sounds too good to be true, it probably is. Trust your instincts and walk away if anything feels even slightly suspicious. Choosing the right chit fund scheme is all about making informed decisions. By comparing options, prioritizing transparency, and listening to your gut, you'll be well on your way to a rewarding chit fund experience.

Finding the Right Chit Fund company is like building a sturdy house - a strong foundation of research and knowledge is key. Remember, your hard-earned money is at stake, so don't rush into any decisions. Take your time, compare your options, and prioritize safety above all else.

Always choose a legally registered company with a proven track record and positive financial health. Trust your instincts and walk away from anything that feels shady or unclear. Remember, research is your best friend! Seek advice from experts, consult credible sources like government websites or consumer forums, and never be afraid to ask questions.

By investing your time and effort in making an informed decision, you unlock the true potential of chit funds. This valuable tool can help you achieve your financial goals, be it a dream home, a child's education, or simply building a secure future. So, be a savvy saver, research diligently, and watch your financial dreams take flight!

Copyright 2022 Chit Market. All Rights Reserved.