Chit Funds 101: How Chit Funds Can Be Your Financial Game Changer

By Sakthi Roopini K January 9, 2024

In today's diverse financial market, amidst numerous investment options like mutual funds and crypto that grab headlines, the concept of chit-fund investments is often overlooked. While accepted by many, some individuals remain in doubt due to occasional scams. Imagine a system where you save alongside trusted friends, access lump sums for life's needs, and borrow without bank hassles. This is possible when you understand the nuances of chit funds and unveil lucrative opportunities. Join us as we navigate the realm of chit funds, exploring how you can harness the potential of Chit Funds to maximize your investment gains. Let's uncover chit funds' mysteries and discover the pathway to reaping their maximum benefits.

What is Chit Fund ?

A Chit Fund operates as a unique financial tool that enables individuals to save and borrow money. It is a decades-old practice thriving in over 20 countries, with India boasting over 50 million active participants! Essentially, it functions as a savings scheme where a group of individuals, typically ranging from 10 to 50 members contribute fixed amounts monthly, and each month, one member receives the entire pot (minus management fees) through a transparent auction or bidding process, facilitated by a Chit Company.

This rotating payout offers both saving options and instant access to large sums like a personal loan, without bank complexities. This process is repeated until every group member receives their share. The Chit Fund, governed by the Chit Fund Act, serves as a secure platform, regulated by law, ensuring transparency and legality in its operations. Through this collective saving approach, Chit Funds offer a flexible means of financial management, providing avenues for both savings and access to funds when needed.

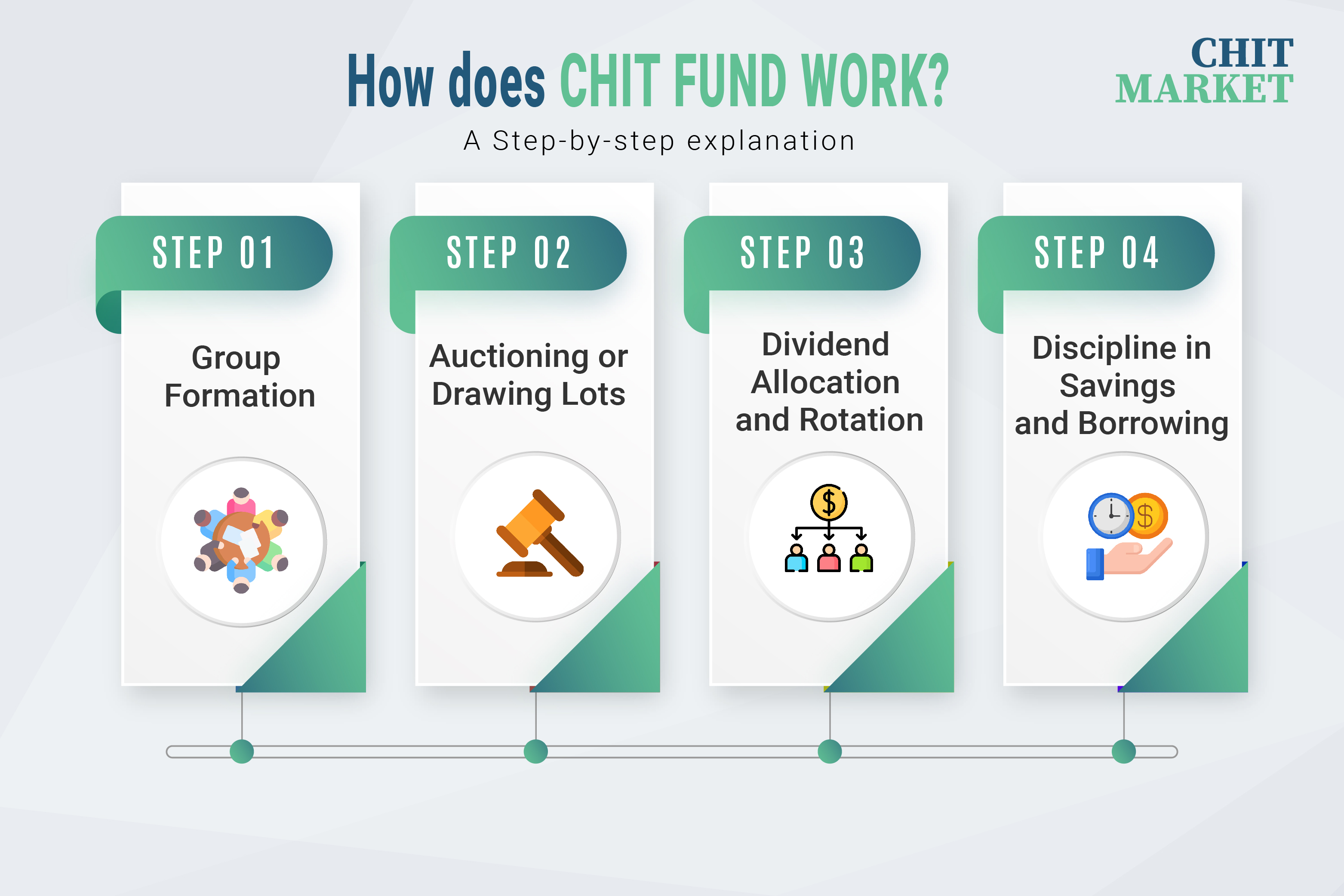

How does Chit Fund Work? A Step-by-step explanation

1. Forming the Group:

A chit company facilitates the process of bringing together customers with similar savings or borrowing needs. You choose the duration (number of months) and value of the chit, with each member agreeing to contribute a fixed sum (installment) every month.

2. The Bid or the Draw:

Each month, the pot of money is awarded to one member. This happens through either a reverse auction, where members bid for the lowest percentage they're willing to accept from the pot or a lucky draw. The member with the lowest bid or winning draw receives the bulk of the pot, minus the chit company's commission.

3. Dividends and Rotating Benefits:

The remaining amount from the pot, after the winner's portion and commission, is distributed as dividends among the other members. This reduces their monthly burden by offering a partial refund. Over the chit's duration, each member gets the chance to receive the full pot sum, effectively rotating the benefit of accessing a large lump sum.

4. Disciplined Savings and Borrowing:

Chit funds encourage disciplined savings due to the regular installments. Additionally, members who win the pot early access a sizeable sum at a discounted rate, making it a convenient borrowing option compared to traditional loans.

This systematic approach allows members to both save money and have access to a lump sum amount when they win the bid, aiding their financial needs. The Chit Company ensures the legality and fairness of the proceedings, abiding by the regulations laid out in the Chit Fund Act, and safeguarding the interests of both customers and the company.

Exploring the Diversity of Chit Funds: Understanding the Various Types

Before joining a Chit Fund, it's important to comprehend the diverse Chit Fund types available. Let us look at each of them in detail:

1. Special Purpose Chit Funds:

These Chit Funds operate with a specific objective in mind. For instance, a group might pool funds to create a savings scheme dedicated to purchasing Diwali sweets. Usually terminating a week before Diwali, the accumulated funds are utilized to make sweets in bulk, subsequently distributed among the members during the festive season. Special purpose Chit Funds streamline efforts and expenses by catering directly to a designated purpose.

2. Organised Chit Funds:

Widely prominent in North India, Organised Chit Funds necessitate regular meetings, either weekly or monthly. Participants' names are written on slips of paper, collected in a container, and a representative randomly selects a slip during the meeting. The chosen participant receives the entire fund, and their name is eliminated from subsequent drawings. The winners are not eligible for future winnings, the selected participant remains present and contributes to subsequent meetings.

3. Online Chit Funds:

The advent of the digital era has propelled Chit Funds into the online domain. Chit companies purchase software that helps them conduct auctions digitally, allowing members to make monthly contributions and receive prize money electronically. Each member manages their contributions and participation through dedicated online accounts, embracing the convenience of digital platforms for fund circulation.

4. Registered Chit Funds:

Regulated by the Chit Fund Act of 1982 enforced by the Reserve Bank of India, Registered Chit Funds obtain registration from the Registrar of Firms, Societies, and Chits. The legal framework ensures oversight and compliance, providing a secure and regulated environment for Chit Fund activities nationwide.

5. Unregistered Chit Funds:

In contrast, Unregistered Chit Funds are organized informally among colleagues, family, or friends, serving as informal savings schemes. However, these funds lack regulatory oversight, rendering them riskier compared to their registered counterparts.

Understanding the nuances and differences among these Chit Fund types is crucial for making informed investment decisions, ensuring alignment with individual financial objectives while considering the level of regulatory oversight and risk tolerance.

Statistics indicate a diverse landscape of Chit Fund preferences across India, with online chit-funds witnessing a surge in popularity owing to technological advancements, while Organised Chit Funds maintain prominence in certain regions, exemplifying the varied choices available to investors within this financial domain.

Benefits of Chit Funds

1. Savings with Returns:

These Chit Funds operate with a specific objective in mind. For instance, a group might pool funds to create a savings scheme dedicated to purchasing Diwali sweets. Usually terminating a week before Diwali, the accumulated funds are utilized to make sweets in bulk, subsequently distributed among the members during the festive season. Special purpose Chit Funds streamline efforts and expenses by catering directly to a designated purpose.

2. Accessibility to Funds:

Widely prominent in North India, Organised Chit Funds necessitate regular meetings, either weekly or monthly. Participants' names are written on slips of paper, collected in a container, and a representative randomly selects a slip during the meeting. The chosen participant receives the entire fund, and their name is eliminated from subsequent drawings. The winners are not eligible for future winnings, the selected participant remains present and contributes to subsequent meetings.

3. Financial Discipline and Planning:

Participating in Chit Funds cultivates financial discipline by instilling a regular savings habit. Additionally, it encourages financial planning as members commit to contributing a fixed amount, aiding in achieving predetermined financial goals.

4. Safe and Regulated:

Governed by the Chit Fund Act, Chit Funds in India operate under regulatory oversight, ensuring transparency, legality, and security for both Chit Companies and customers. This regulation safeguards the interests of participants within the Chit Market, enhancing trust and reliability.

5. Flexible and Inclusive:

Chit Funds accommodate various income groups, allowing both small and large investors to participate. This inclusivity makes Chit Funds an accessible investment avenue across diverse socioeconomic backgrounds, fostering financial inclusion.

6. Community and Networking:

Chit Funds foster a sense of community among members, promoting social connections and trust. Regular meetings and interactions among members in Chit Funds not only aid in financial matters but also strengthen social bonds within the community.

7. Potential for Higher Returns:

For successful bidders, Chit Funds offer the prospect of obtaining the entire chit value, resulting in substantial returns. This potential for higher returns, coupled with the safety and legality of the Chit Fund Act, attracts investors seeking profitable yet regulated investment opportunities.

These benefits showcase the multifaceted advantages of Chit Funds within the financial landscape, offering a blend of savings, returns, discipline, and community engagement while operating within a regulated framework defined by the Chit Fund Act.

In conclusion, the world of Chit Funds offers a compelling proposition within the financial spectrum, often overlooked amidst other investment options. By understanding the intricacies of Chit Funds, individuals can harness a multitude of advantages for their financial well-being. From disciplined savings and access to funds without conventional banking intricacies to fostering community ties and offering lucrative returns, Chit Funds serve as a versatile and inclusive financial tool.

When seeking a secure and trusted avenue to invest in Chit Funds, Chit Market emerges as the go-to platform. It stands as a beacon of reliability and transparency, offering a regulated environment governed by the Chit Fund Act. Chit Market serves as a trustworthy gateway connecting investors with reputable Chit Companies, ensuring safety and legality in every transaction.

Are you ready to invest in Chit Funds? Join Chit Market to find the trusted Chit Companies near your Location

Copyright 2022 Chit Market. All Rights Reserved.